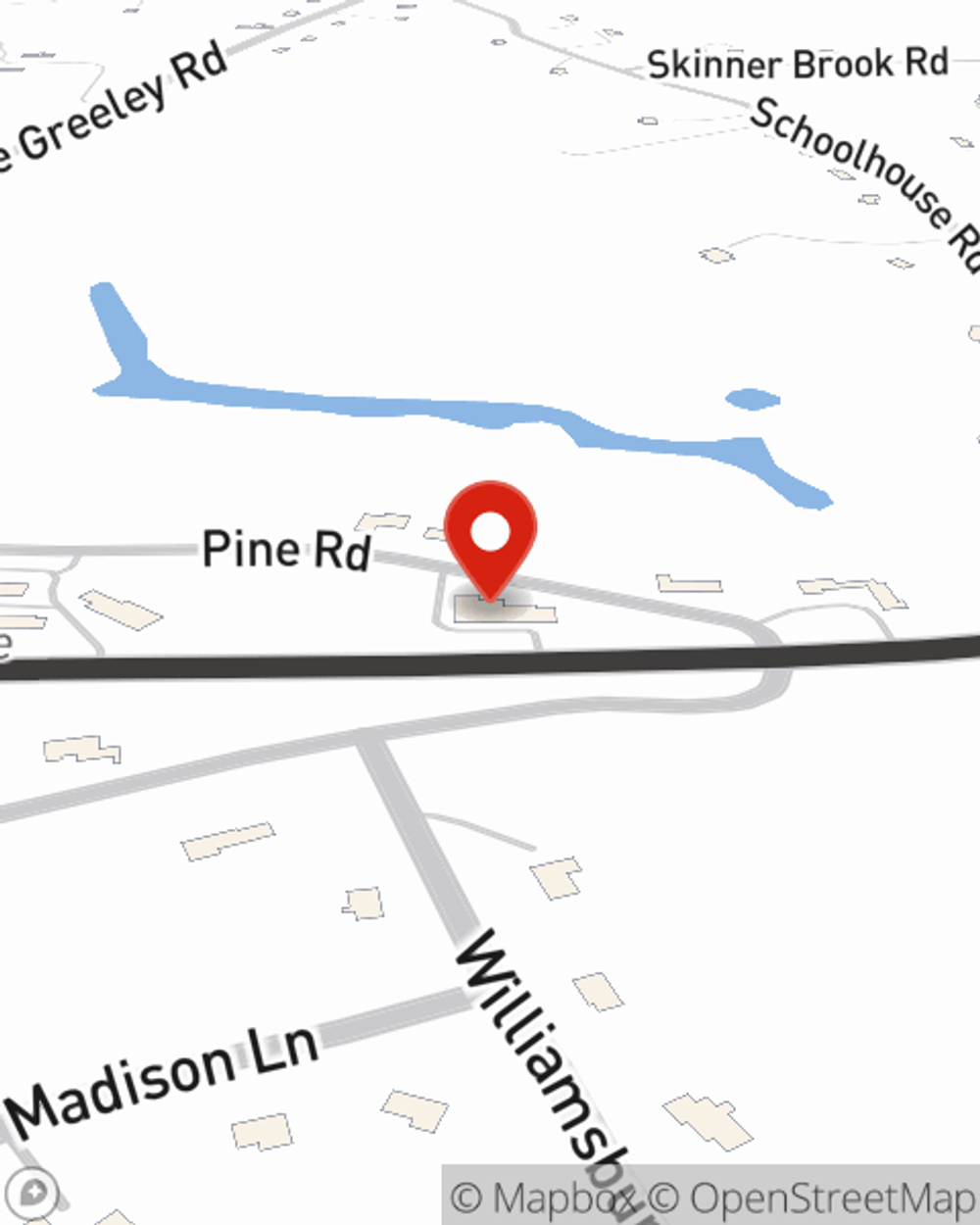

Business Insurance in and around Amherst

Looking for small business insurance coverage?

Cover all the bases for your small business

Insure The Business You've Built.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Pete Ackerson. Pete Ackerson can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

Cover all the bases for your small business

Get Down To Business With State Farm

For your small business, whether it's a dry cleaner, a shoe store, an ice cream shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like buildings you own, computers, and equipment breakdown.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Visit State Farm agent Pete Ackerson's team today to get started.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Pete Ackerson

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.